Schedule a Call Back

search Result

India’s growing economy gets budget’s booster dose

The budget has laid down a blue print for achieving the objective of Atmanirbhar Bharat and sustainable development in the future. However, it will be important to look at the execution, on which the success of all the policy announcements will depend.Read more

Budget 2022 - Govt's Rs 7.5 lakh cr capex to augment machine tools demand: V Anbu

Budget 2022 is a booster shot for Indian manufacturing and ease of doing business, says V Anbu, Director General & CEO, IMTMA, who reflects on how the budget fares for the Indian machine tool industry.Read more

Budget 2022 shows commitment to energy transition, climate action

Proper implementation of action plans and policies (announced in the budget 2022-23) will open doors for the localisation of many green technologies and create a new green technology market in India, says Rudranil Roy Sharma.Read more

Budget 2022 - Govt increases capex by 35% to Rs 7.50 trn in 2022-23

In defence sector, 68% of the capital procurement budget will be earmarked for domestic industry in 2022-23, up from 58% in 2021-22. Defence R&D will be opened up for industry, start-ups and academia with 25% of defence R&D budget earmarked.Read more

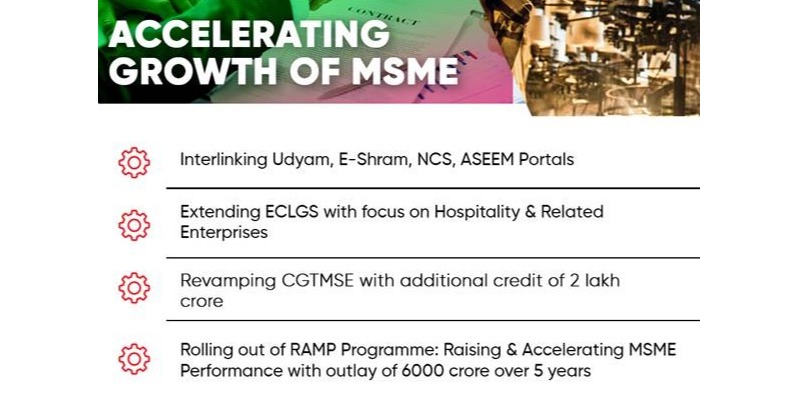

Budget 2022 announces additional credit of Rs 2 trn for MSMEs

Budget 2022 announces additional credit of Rs 2 trn for MSMEs Credit will be available through revamped Credit Guarantee Trust for Micro and Small Enterprises Scheme (CGTMSE). The government will roll out “Raising and Accelerating MSME Performance†(RAMP) programme with outlay of Rs 60 billionRead more

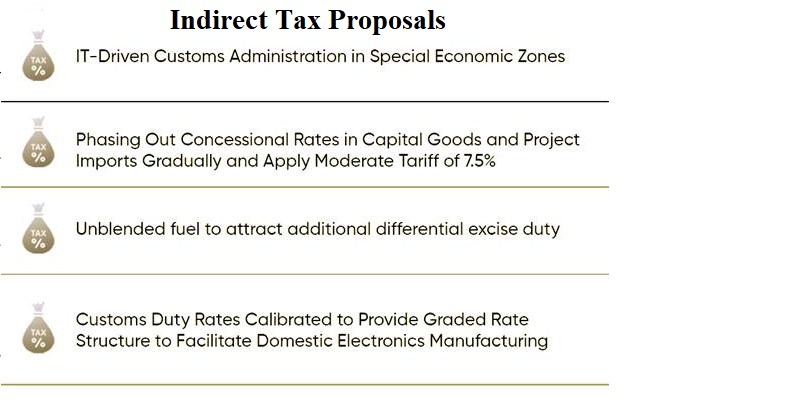

Budget 2022 - Customs duties rejigged to promote Make in India & exports

Concessional rates on capital goods to be gradually phased out and attract a moderate tariff of 7.5%. More than 350 entries to be phased out from customs duty exemption to promote Make in India and Aatmanirbhar Bharat. Graded duty rate structure to boost domestic electronics manufacturingRead more

Budget 2022 allocates Rs 195 bn PLI incentive for solar module production

With focus on circular economy, Budget 2022 tables proposal to co-fire 5-7% biomass pellets in thermal power plants, with expected CO2 savings of 38 mmt. It also announced four pilot projects for coal gasification and conversion of coal into chemicals.Read more

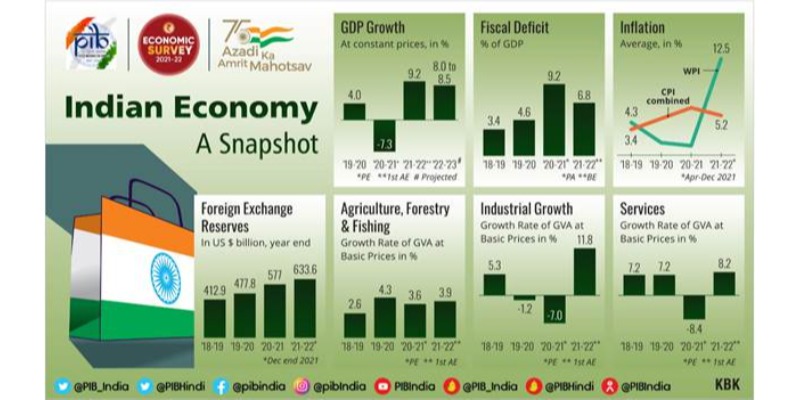

Budget 2022 - Economic Survey: Industrial sector to expand 11.8% in 2021-22

According to the Survey, investment, as measured by Gross Fixed Capital Formation (GFCF) is expected to see strong growth of 15% in 2021-22 and achieve full recovery of pre-pandemic level.Read more

Budget 2022 should build confidence in new manufacturing firms

Government has reduced tax rate for newly set-up manufacturing company to an effective rate of 17.16%. However, there are certain nuances which require clarifications. Maulik Doshi highlights on budget expectations for new manufacturing companies availing concessional tax rates.Read more

Budget 2022 - IMTMA: Cohesive efforts are need to resuscitate growth

Budget 2022 should provide a higher depreciation of 25% on procurement of new indigenous capital goods besides mandatory registration under TReDS for all companies with a turnover beyond Rs 250 croresRead more